OVERVIEW

R&J Strategic Communications engineered and implemented a successful digital advertising campaign to generate highly-targeted leads for Sacks & Associates, a wealth management company.

CHALLENGE

Sacks & Associates is a team of experienced wealth managers who specialize in helping high-net-worth clients achieve their long-term financial goals. As we always do when onboarding new clients, we kicked off our engagement with Sacks & Associates, by conducting a deep-dive discovery process. One of the primary objectives of this discovery was to define success for the client’s marketing program.

The Sacks & Associates team explained that, for their business, securing one or two new accounts would alone justify the cost of our marketing program. To do this, it became clear that the focus of our digital marketing activities must be a lead-generation campaign, highly-targeted to the high-net-worth demographic that Sacks & Associates services.

ACTION

Over the course of a two-month period, R&J created two distinct Facebook advertising campaigns designed specifically to generate qualified leads for Sacks & Associates. In both cases, the campaigns promoted gated content on the Sacks & Associates website that was made available to visitors in exchange for providing their contact information, including e-mail address, which was then funneled into the Sacks & Associates lead management process.

The first campaign promoted a series of videos, with advice from the Sacks & Associates team on how to maximize Social Security benefits. We conducted A/B testing with different Call-to-Action (CTA) buttons ‘Learn More’ and ‘Sign Up’ to see which would resonate more with our targeted demographic.

The objective of the second campaign was to promote a Tax Preparation Checklist, another piece of owned content on the client’s website. We targeted the same audience as the previous Social Security ad campaign, however, we excluded users who had previously submitted an email address in the first campaign.

CAMPAIGN ANALYSIS

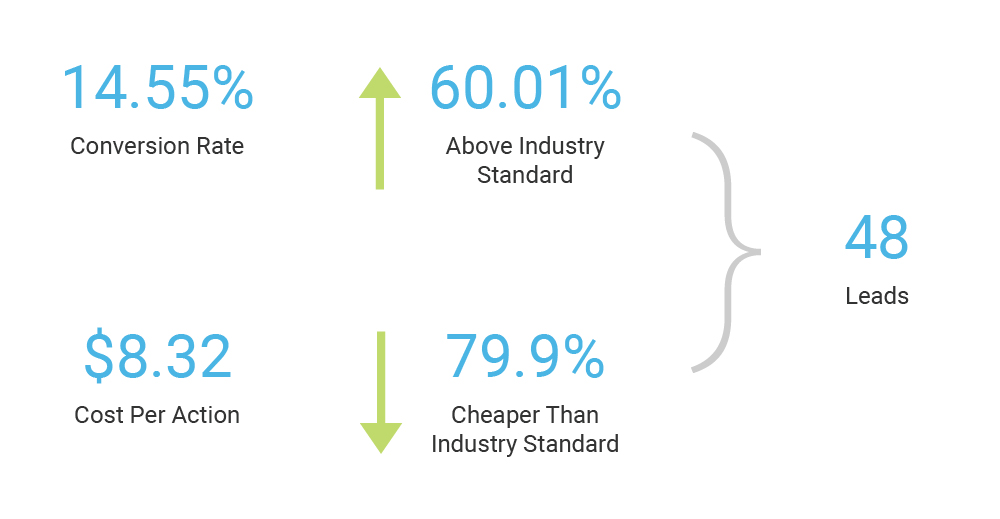

Since the objective of both campaigns was to encourage email captures using the Social Security web series and tax preparation checklist as gated content, conversion rate was an important metric for measuring success. Here, the conversion rate measured the percentage of the ad’s audience who submitted their contact information. We also considered industry benchmarks while assessing campaign performance, as an indication of campaign performance compared to an industry average.

One of the advantages of social advertising campaigns is the ability to monitor ad performance and make adjustments to optimize performance as the campaign is running. In reviewing the first week’s performance of the Social Security campaign, we noticed the conversion rate was lower than industry standards (2.94%), so we transitioned from a landing page views campaign to a conversions campaign. This allowed us to optimize the ad to generate more email captures and improve the conversion rate.

In the third week of the campaign, we made additional adjustments to our target audience. The age group we were previously targeting was 35+, however we noticed 35-54 year-olds were not engaging with the ads as well as we’d hoped. We then allocated the remainder of the budget to target the better performing age group, which was 55+, so that we could garner the best results possible with the remaining budget.

After making the refinements noted above, the conversion rate improved significantly, increasing by 394.9% to a 14.55% CVR and surpassing the industry standard by 60.1%. The campaign also resulted in a cost per action (lead) of $8.32, which is 79.9% lower than the industry standard. Ultimately, the campaign outperformed all financial industry benchmarks, and, importantly, generated 48 qualified leads.

The Tax Checklist campaign, like the Social Security ad campaign, also focused on lead generation via gated content. As such, the conversion rate (CVR) remained a key metric in this analysis. However, we also examined the click-through-rate (CTR) and cost-per-click (CPC), which provide insight into the performance of the ads themselves.

The click-through-rate is the percentage of people who perform a link click out of the total number of people who saw the Facebook ad. Cost-per-click is the dollar amount paid per link click. A successfully campaign will typically have a higher CTR, and a lower CPC.

Compared to the Social Security ad campaign, the CTR decreased significantly, however still exceeded the financial industry average of 0.56% by 42.9%. This was expected, however. While the Social Security ads promoted a video content, we were able to utilize these assets in our campaign. The tax checklist campaign relied on static images, which typically do not perform as well as video.

However, those that did click through to the Tax Checklist landing page found the content enticing and were more likely to submit their email address in exchange for access to the information. So while the click-through-rate for this campaign was lower, the conversion-rate was 106.2% higher than in the Social Security campaign, and 230.03% above the financial industry benchmark.

CONCLUSION

Targeting a narrow audience of high-net-worth individuals, R&J Strategic Communications created a campaign perfectly aligned with our client’s primary marketing objective—to grow the Sacks & Associates business with new accounts. Because the nature of the client’s business model is not focused on volume, but rather a small subset of the financial services market, a digital campaign enabled us to be very precise and very cost-effective in targeting our desired demographic.

Building a campaign around this specific niche, we were able to provide the client with nearly 50 qualified prospects for the Sacks & Associates lead management program.